Second, i studies which benefits from student loan forgiveness because of the income

By the Society Income

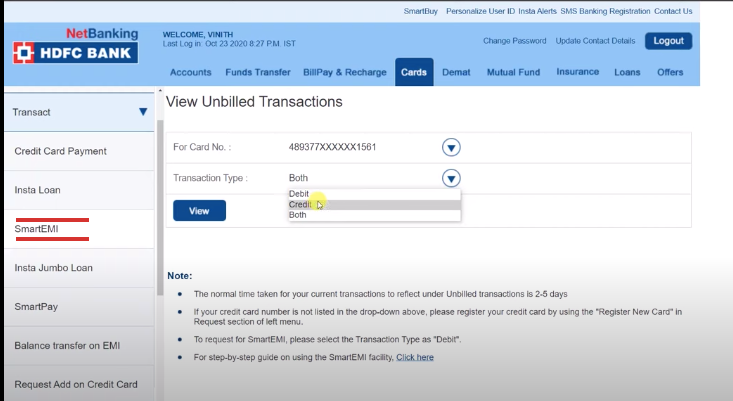

As we really do not physically observe income for people on data, we assign men and women to a living classification of the average income of its people owing to Census cut off group designations. I separated money to your quartiles to the low quartile identified as low-income (which have a median annual money lower than $46,310), the guts a couple of quartiles once the center-money (anywhere between $46,310 and you may $78,303 per year), and the highest quartile because high-income ($78,303 and you may more than a-year). Borrowers living in large-money portion may owe government student education loans and you can hold higher balances. Despite are 25 % of the people, borrowers who live inside the higher-earnings neighborhoods keep 33 % away from government stability when you’re individuals living in the lower-income portion hold only 23 % of stability. Less than one another forgiveness profile instead income limits, low-earnings neighborhoods discovered around 25 % of loans forgiveness when you find yourself large-money communities receive up to 30 % from forgiveness. Enhancing the threshold away from $ten,100 to help you $fifty,000 leads to a somewhat large display regarding forgiveness so you can highest-money elements. An average federal student loan debtor staying in a premier-income community perform receive $twenty-five,054 since mediocre borrower living in a decreased-earnings society manage discover $twenty two,512. By contrast, including a good $75,000 earnings cover to possess forgiveness qualifications significantly changes the latest express off positives. New express away from forgiven dollars attending high-income parts falls throughout 30 percent to over 18 % plus the express of forgiven personal debt likely to lowest-earnings areas expands from all over 25 percent to around 34 per cent.

Sources: Nyc Fed/Equifax Credit Committee; Western Area Survey 2014-2018; authors’ computations.Notes: I designate men and women to a full time income class by the average money of their area as a consequence of Census stop classification designations. The lower-money class is short for individuals with an area income average below $46,310 a-year, the center-money class between $46,310 and $78,303, therefore the highest-earnings classification $78,303 or even more. Overall shares for each coverage will most likely not contribution to 100 % because of rounding otherwise missing identifiers.

Of the Credit history

I plus song brand new display out of federal education loan forgiveness you to definitely manage work for people who have various other quantities of monetary balances because of the categorizing her or him to the credit score bins. I play with fico scores out-of because in earlier times unpaid federal education loan borrowers knowledgeable higher credit score develops whenever the membership were marked most recent because of pandemic forbearancepared for the populace out of You.S. grownups which have a credit history, education loan consumers has significantly all the way down credit scores. More or less 34 percent of all of the credit scores is actually greater best personal loans in Portland than 760, however, just 11 percent regarding student loan individuals have this type of super best scores. Whenever adjusted by the harmony, education loan individuals provides high ratings recommending that people with a high balance have higher credit ratings. Below all four regulations, over fifty percent the share from forgiven loans would go to borrowers which have a credit score less than 660. Just as in all of our study by the money, improving the endurance from $10,100000 in order to $50,100 escalates the display away from forgiven balances gonna individuals with credit scores away from 720 or more, indicating that increased for each and every debtor forgiveness number can work with consumers away from high socioeconomic condition a whole lot more. not, earnings limits slow down the express out of professionals browsing those with very finest ratings and you may directs a more impressive display out-of forgiveness to individuals with down fico scores.

Sources: Nyc Given/Equifax Consumer credit Committee; authors’ calculations. Note: Total offers for each plan may not share so you’re able to completely because of rounding otherwise shed identifiers.

By the Community Demographics

I 2nd have a look at whom benefits from forgiveness predicated on demographic attributes out-of a beneficial borrower’s area. I separate borrowers toward several categories: people that are now living in a beneficial Census cut-off class with more than 50 % away from residents pinpointing as light low-Hispanic (most white) and those who inhabit a Census take off category that have at most 50 percent light non-Hispanic residents (most fraction). Those people staying in most white and you can majority minority communities was similarly probably are obligated to pay student loans; around 67 per cent of one’s population and you may 67 per cent out-of federal student loan consumers live-in most white areas and you will equilibrium shares is broke up about in the same proportion. Significantly less than an effective $10,000 forgiveness policy, 33 per cent off forgiveness visits most minority neighborhoods while 67 percent visits bulk white neighborhoods. Subsequent broadening forgiveness of $10,100 so you’re able to $fifty,one hundred thousand doesn’t notably changes these types of offers. However, establishing an income cover regarding $75,000 for eligibility significantly advances the show off forgiven money heading in order to vast majority minority communities-out of approximately 33 per cent regarding forgiven personal debt in order to 37 per cent during the both forgiveness membership.